Some investing mistakes can be obvious very quickly, while others may take years to become apparent – and it may be too late to repair the damage.

Whether you’re a seasoned investor or just starting out, let’s look at seven common investing mistakes to avoid.

Mistake 1: Having a concentrated portfolio

One of the biggest mistakes you can make as an investor is having your portfolio concentrated in a small number of stocks, or a single asset class – in simple terms, putting all your eggs in one basket. This means the fate of your entire portfolio depends on the performance of a small number of investments.

To avoid this, you need to diversify your investments. Diversification is spreading your investments across multiple geographic regions, industry sectors and asset classes. By doing so, you spread your investment risk and reduce the impact on your overall portfolio if one part of the portfolio underperforms.

Mistake 2: Missing out on compounding

Compounding refers to earning returns on both your original investment and on subsequent returns.

In order to reap the benefits of compounding, you should consider reinvesting the income from your investments, which we cover in the next point.

Simply put, the sooner you start putting your money to work, the more you’ll benefit from the compounding effect and the less you’ll have to save to reach your goals.

Mistake 3: Not investing regularly

One effective approach is to invest at regular intervals, in a strategy known as dollar cost averaging. This involves investing the same amount of money at set intervals (for example monthly or quarterly) over a number of years, whether market prices are up or down.

When prices are up, your fixed dollar amount will buy fewer units. When prices are down, your regular investment will buy more.

The point of dollar cost averaging is not to try and pick whether the market is going to rise or fall, but rather to remove timing from the equation.

Mistake 4: Letting your emotions drive your decisions

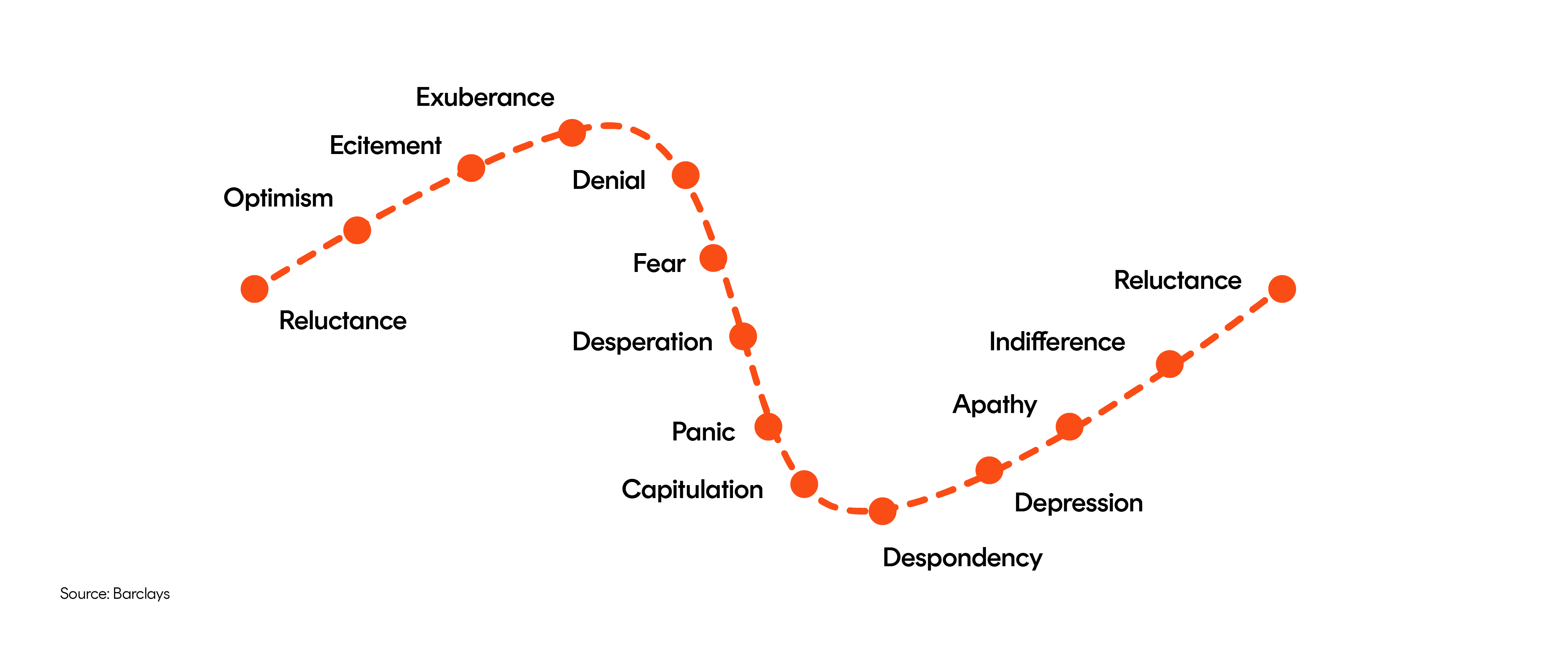

Sometimes our emotions can affect our investment choices – and not for the better. As we enter market upturns, the optimism and excitement of rising values can lead us to think that making gains will be easy (1).

These positive emotions can lead us to increase our level of risk at a time when we should be more cautious.

On the other hand, when markets are in a downturn, panic and fear may prevent us from investing, cause us to reduce our risk levels, or even lead us to exiting markets altogether – at precisely the wrong time.

It is important to ask yourself whether your investment decisions are rational, or are being driven by your emotions?

Mistake 5: Having vague investment goals (or none at all)

If you are going on a journey to a new destination, you are likely going to need a map to ensure that you don’t get lost along the way. This also applies to investing.

Be clear on what you are trying to achieve. For example, are you saving for a deposit on a house? Or are you saving for retirement?

It is important to be able to articulate your goals as these will largely direct your strategy and the level of risk you are comfortable taking on to reach these goals.

Mistake 6: Poor record-keeping

Each time you buy or sell an investment, you’ll receive material that you’ll need at tax time to work out your capital gains or losses. At the end of the financial year, you will also receive information regarding the distributions from any investments you hold, which need to be reported in your annual tax return.

Misplacing this material will cause a major headache, so ensure that you keep it in a safe, easy-to-find place.

Mistake 7: Paying too much in fees

It would be nice if you could control markets and their impact on your investments, but unfortunately, you can’t. One thing you can control, however, is the amount you are paying in fees.

Small differences in fees may not appear to matter to your overall investment portfolio, but they can have a significant impact on your returns over time.

As an example, Betashares' A200 Australia 200 ETF , which provides exposure to the largest 200 companies on the ASX, is ultra-low cost, with a management fee of 0.04%* (or just $4 for every $10,000 invested).

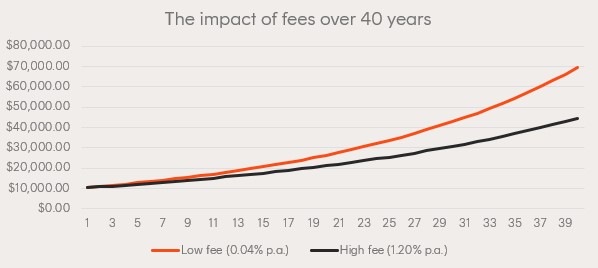

To illustrate, the chart below compares the investment return of A200 with a hypothetical actively managed fund with a similar strategy (Australian shares), assuming:

– Pre-fee returns of 5% p.a. for both funds

– A starting balance of $10,000

– A200’s current management fee of 0.04% p.a.*

– An active management fee of 1.20% p.a.**

Over 40 years, the lower-fee ETF investment would grow to be worth $69,335, compared to the higher-fee managed fund investment value of $44,452. The low-fee option would be worth around $24,900, or 56%, more than the high-fee option after 40 years.

*Management fee includes other ongoing expenses of the Fund, excluding transaction costs of buying and selling the Fund’s investments. Refer to Product Disclosure Statement for more information.

**Represents the average investment management fee for Australian domiciled open-ended actively managed large Australian equity funds in the large blend, large growth and large value Morningstar fund categories. Excludes index funds. Source: Morningstar Direct. Data as at 31 January 2023.

Illustrative only. Assumed performance is not indicative of actual performance Actual performance of A200 and actively managed Australian share funds may differ and may be higher or lower than the assumed performance.

Takeaways

Even the most successful investors make mistakes along the way. But being aware of these common investing mistakes can help you to avoid them, and keep you on track to building a successful investment portfolio.

If all else fails, remember to diversify your portfolio, take advantage of compounding, make rational decisions, set clear goals, keep your records safe, and keep an eye on fees.

Learn more here.