What are critical minerals?

According to Geoscience Australia, a critical mineral is a metallic or non-metallic element that is essential for modern technologies, economies, or national security, and has a supply chain risk of disruption due to geopolitical issues, trade policy or other factors(1).

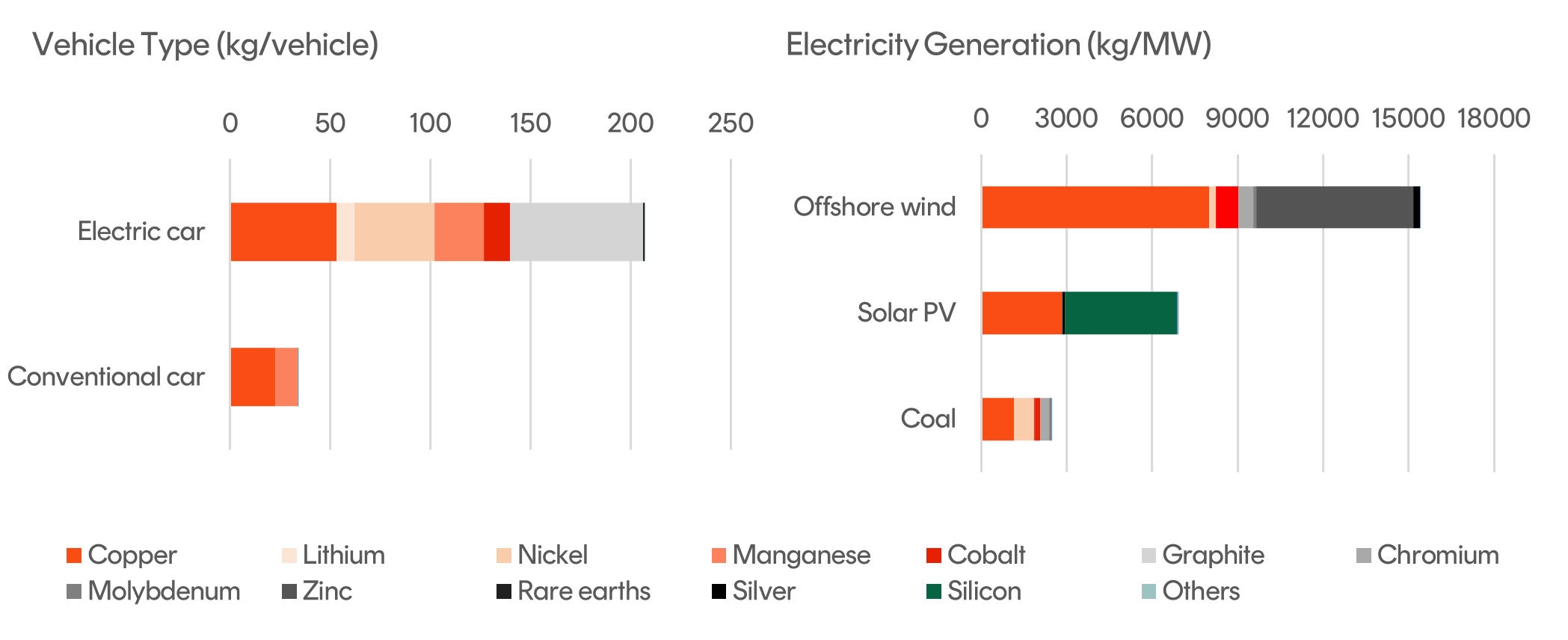

Critical minerals are integral to the realisation of Net Zero goals and are used across a range of clean-energy infrastructure such as solar panels, wind turbines, and electric vehicles (EVs). Clean energy technologies are more material-intensive – they require more minerals to build vs their fossil fuel equivalents(2). Below is an example that highlights material use across clean energy technologies.

Source: International Energy Agency, May 2021. Sprott, August 2022. The intensities for an electric car are based on a 75 kWh NMC (nickel manganese cobalt) 622 cathode and graphite-based anode. Offshore wind is based on the direct-drive permanent magnet synchronous generator system. Coal is based on an ultra-supercritical plant. Silver usage in solar PV generation is based on 20 grams used per solar panel. Actual consumption can vary by project depending on technology choice, project size and installation environment.

Demand is projected to be ‘off the charts…’

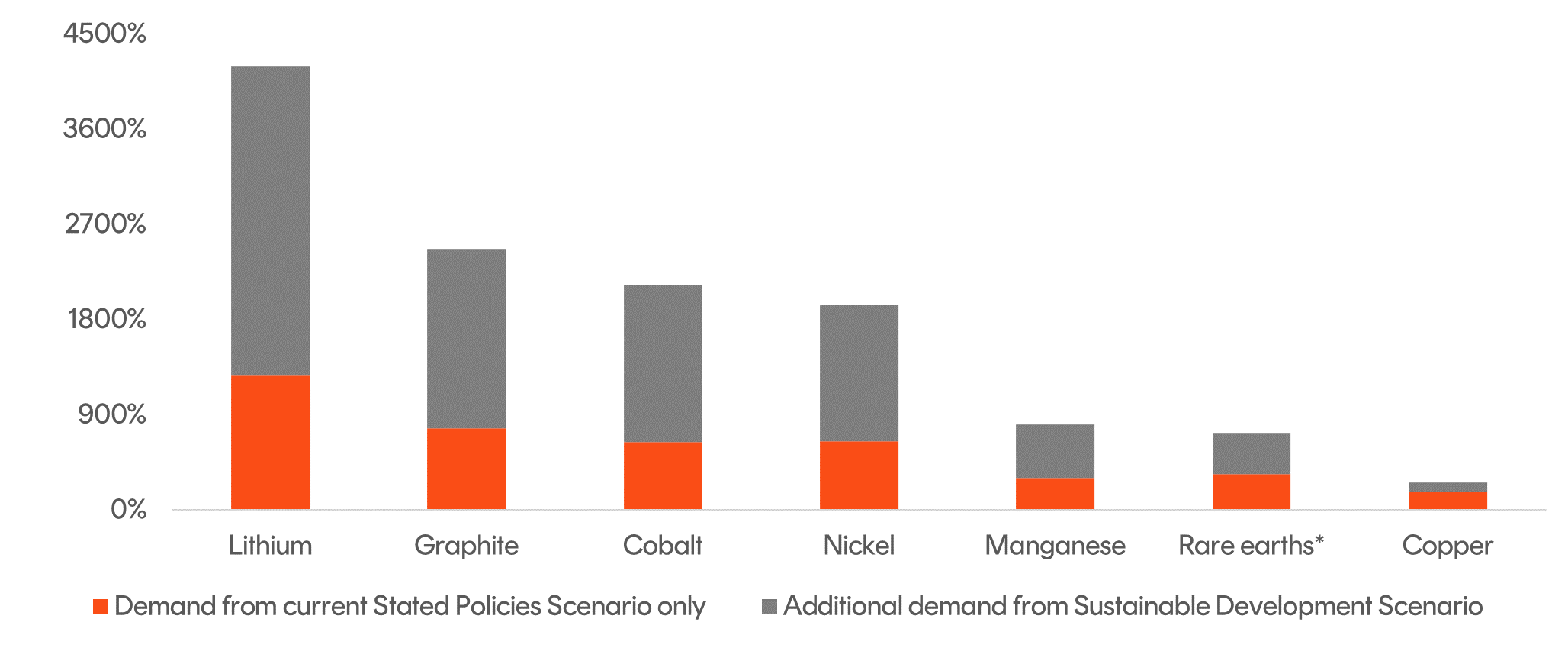

Critical minerals such as lithium, cobalt, graphite, and rare earth elements are crucial components in rapidly growing clean energy technologies, and demand for these minerals is likely to accelerate as the energy transition gathers pace. So too the demand for conductive base metals like copper and nickel. The International Energy Agency (IEA) forecasts that, based on current government policies (Stated Policies Scenario), 2040 demand for lithium will be ~13 times 2020 demand . Based on Paris Agreement-aligned adoption of clean energy technologies (Sustainable Development Scenario), demand for lithium by 2040 could be up to ~42 times 2020 demand.

Projected growth of selected minerals demand in 2040 relative to 2020

Source: International Energy Agency, May 2021. Demand from non-energy sector use of Energy Transition Materials (ETMs) was assessed using historical consumption, relevant activity drivers and the derived material intensity. *Neodymium demand is used as indicative for rare earth elements. Stated Policies Scenario is an indication of where the energy system is heading based on a sector-by-sector analysis of today’s government policies and policy announcements; Sustainable Development Scenario indicates what would be required in a trajectory consistent with meeting the Paris Agreement goals. Actual outcomes may differ materially from projections.

…Though supply is the bigger challenge

A major challenge facing this sector is the geographic concentration of supply chains, with China being the dominant player. Globally, China refines 68% of nickel, 40% of copper, 59% of lithium, and 73% of cobalt(3/4). But while China dominates the downstream market, it is not as important in the upstream market, with Australia and Chile mining more than 70% of global lithium, and the Democratic Republic of the Congo (DRC) accounting for nearly 70% of cobalt mining.

The geographic concentration of processing operations in China is a key vulnerability for the energy transition(5). Both the European Union and the United States have recognised dependence on China for critical inputs and technologies as a major reason to increase their critical mineral supply chain resilience(6).

But there is a question mark over whether the West can achieve its goal of securing critical minerals’ supply chains, as China has dominated this market for more than three decades and new investments have a long lead time(7).

Australia is poised to be a global leader in critical minerals

Australia is a world-leading critical minerals exporter and is one of the top producers of lithium. Globally, countries are looking to diversify their clean energy supply chains, and Australia can play a crucial role in potentially de-risking the global critical minerals supply chain. According to the International Monetary Fund, Australia is well-placed to benefit from a massive surge in demand for critical minerals estimated at U$12.9 trillion over the next two decades(8). However, to fully exploit this opportunity, Australia needs to push further into downstream refining and component manufacture, leveraging its potential access to unlimited amounts of low-cost renewable energy(9).

In May 2023, the United States and Australia signed the Climate, Critical Minerals and Clean Energy Transformation Compact. One of the key components of the agreement is to support the expansion and diversification of clean energy and critical minerals supply chains(10). As part of this agreement, the United States will consider classifying Australia as a domestic supplier within the US Defence Production Act (DPA). This move will significantly reduce barriers for US investment and grants and subsidies under the Inflation Reduction Act to flow into the Australian critical minerals sector and enable Australia to ramp up its critical minerals exports. In addition, the two countries will set up a new Taskforce on Critical Minerals and increase information sharing and coordination in the critical minerals sector(11). The details and specific components of the deal are expected to be announced by the end of 2023.

In July 2023, the Federal Government released the Critical Minerals Strategy 2023-2030, with a focus on providing a framework that will guide future policy development(12). The Government has also initiated a consultation process to review and update the list of critical minerals as inconsistencies between Australia and other countries’ lists result in domestic critical mineral companies missing out on opportunities offered by key trading partners and international counterparts(13).

Mining of critical minerals – is it green enough?

Mining or extraction of any mineral can be carbon-intensive, result in soil degradation and water shortages, and damage local ecosystems. Mining of critical minerals is no exception. For instance, lithium extraction harms local ecosystems, results in air contamination, and can cause water shortages(14). Production of critical minerals is energy intensive and can lead to significant carbon emissions, but this does not negate the decarbonisation advantages of clean energy technologies: the end use case of critical minerals when considered over the full cycle of emissions compared to other technologies. Total lifecycle greenhouse gas emissions of EVs are around half those of internal combustion engine cars on average, with the potential for a further 25% reduction with low-carbon electricity(15).

Multi-year investment thematic that is just getting started…

The energy transition is here to stay, and critical minerals will play a crucial role in enabling the technologies underpinning the transition. A significant increase in demand is likely for critical minerals over the coming decades as this transition accelerates. Additionally, government strategies focused on energy security will see a ramp-up of investments in the sector.

Learn more

For more information, please visit Betashares' website.