Preview

We believe that navigating the uncertainties and opportunities in global fixed income in 2024 will require a nuanced and dynamic approach, involving a combination of prudence, adaptability and foresight.

Geopolitical tensions are increasingly at the forefront, with ongoing conflicts and global power rivalries intensifying. The protracted Russia–Ukraine war, along with the evolving dynamics in US–China relations, are pivotal in this regard.

Moreover, the urgent need to expedite the transition to a low-carbon economy to mitigate the severe impacts of climate change presents new challenges. Concurrently, corporations and governmental bodies are compelled to adapt and revise their strategic frameworks to address the rapid evolution of generative artificial intelligence (AI) and other technological advancements, coupled with the increased risk of cyberattacks.

At the same time, macroeconomic factors like rising inflation and potential recessions further complicate matters. The prolonged period of inexpensive capital that prevailed since the global financial crisis has ended, and we have returned to a milieu of higher real interest rates. This shift toward a sustainably higher cost of debt, combined with an increase in debt maturities and a likely slowdown in economic activities in 2024, has refocused attention on the essentials of credit fundamentals and liquidity analysis. On top of this, financial markets themselves are evolving rapidly, with new asset classes and complex derivative instruments adding layers of uncertainty.

Faced with this situation, investors must navigate a precarious path. Staying invested is crucial to meet their long-term objectives, but doing so blindly in volatile markets can be disastrous. Conversely, excessive focus on liquidity sacrifices potential returns and might not ensure enough reserves for unexpected emergencies. This delicate equation becomes even more intricate when considering specific mandates, risk tolerances, and investor profiles.

Navigating this complex landscape requires a multi-pronged approach. This intricate environment demands a nuanced and forward-thinking approach from debt market issuers and investors, emphasizing the importance of agility, comprehensive risk assessment, and strategic foresight.

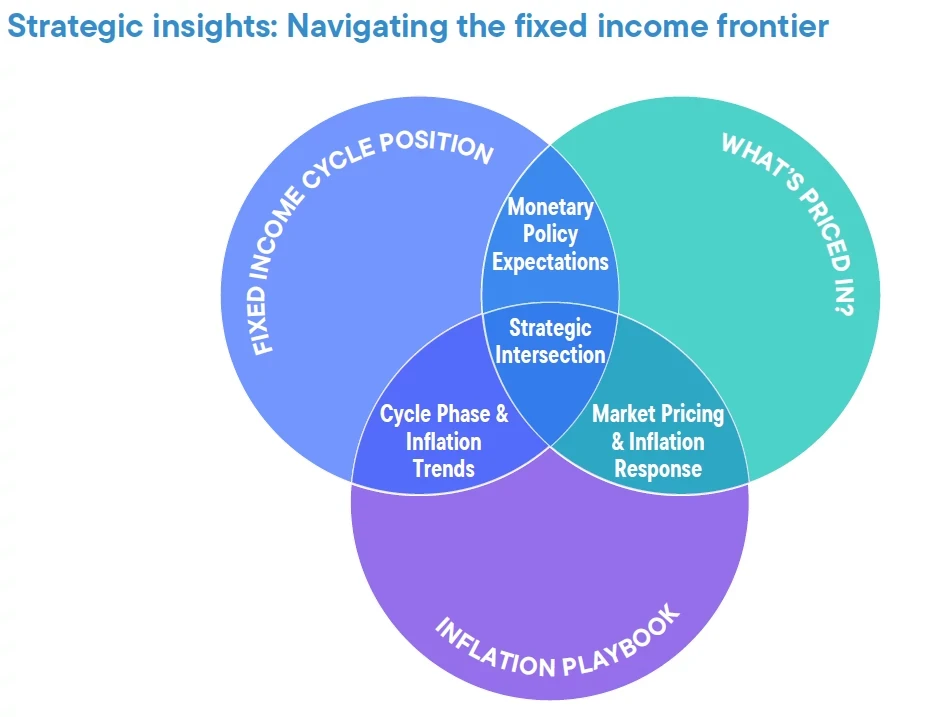

The strategic intersection, or “ikigai,” of fixed income investing in 2024 lies where the understanding of the fixed income cycle, current market pricing, and inflation trends converge. We believe this nexus is vital for crafting well-informed investment strategies that adeptly navigate the complexities of the financial landscape.

Read the full paper to learn more.

Learn more

For more information, please visit Franklin Templeton website.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Sovereign debt securities are subject to various risks in addition to those relating to debt securities and foreign securities generally, including, but not limited to, the risk that a governmental entity may be unwilling or unable to pay interest and repay principal on its sovereign debt. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.